|

Over the past few days, we have seen the annual numbers and reports from the two largest domestic theme park companies in the USA - Cedar Fair & Six Flags Inc. (Note: Disney does not qualify as it is a multi-tiered corporation of which the theme parks are only a part of a much larger equation.) It is a tale of woe and WHOA. Let's look at the two companies in comparison first:

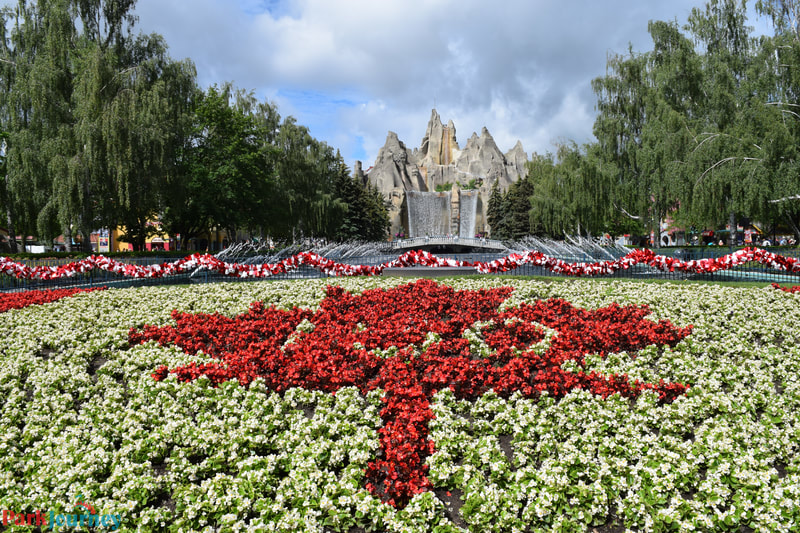

In essence, Cedar Fair is roughly 1/2 the number of parks overall... and yet generating nearly the same operating revenues as Six Flags. In addition, they are making more money per person in the parks that Six Flags is, and with significantly higher attendance per park overall. Cedar Fairs numbers for the year were spectacular, featuring attendance, revenue and overall spending leaps across the board. In essence: Almost every park in their chain saw growth in attendance, and more importantly, in long-term overall growth of the pass-holder base. Organic (Ticketed/non-pass-holder) ticket growth was up 12% - a huge leap in itself. Six Flags had nearly the opposite: While there was a <very> modest growth overall in attendance (less than 2%) they were hit with a double-whammy of lower per-capita spend, and even lower renewal of season passes and in their membership programs. Overall, their attendance was down at many parks, notably in part due to the delays in opening several key attractions in their chain, as well as lack of new-attendance spending in other markets. Organic (Ticketed/non-pass-holder) ticket growth dropped by 4% overall. As I had said a few weeks back, the situation at Six Flags Inc is in seriously bad shape. Facing some fiscal indigestion that is getting worse by the year, as well as all new leadership at the company, we are seeing a frustrating and almost impossible to deal with future growth position. Their new president, Mike Spanos has been handed the reigns of a company which has some severe problems from the ground up - and has been forced by the previous administration there to make some very difficult calls - such as slashing the dividend payouts by 75%, and looking at a future which at best will see the company shrink to try and stave off bankruptcy filing. Cedar Fair on the other hand has paved a road of gold and is looking to immerse guests further in the next few years. Richard Zimmerman's changes overall have been beneficial in growing the base, as well as growing the future of the company via more guest-friendly experiences, and to bring a new personality to each of the regional parks in the system. While their 2020 park spend is primarily in re-inventing their water parks at most of their parks, clues are already dropping that 2021 will see some new blockbuster attractions at some of their parks - notably Kings Dominion. In addition, the arrival of two new wholly-owned water parks (formerly Schlitterbahn parks) gives them new facing in Texas - a market currently dominated by Six Flags Inc & Sea World Entertainment. A very strong revenue growth in their hotel properties - and the addition of hotels at both Carowinds and Canada's Wonderland is showing very promising growth in non-core revenues, further stabilizing the company fiscally. It is clear that both companies are on very different courses - and that one has paid out handsomely and the other brought the company to the brink of failure. I won't go into the course changes needed at SFInc. I covered that in my previous analysis of the company a few weeks back. I will say this: Looking at their current vision for 2020, the outlook is not pretty. Spanos has predicted a soft year financially, and a challenging one due to the mistakes of the past. He has a job on his hands which will require extensive re-think of the company, a revisiting to their roots, and an ability to turn the company around with little on hand to do it with. They need fresh ideas and new concepts, and not re-hashes of what they've been staring at for the past decade. (I have a long list, Mr. Spanos, of things which you need to be doing right now... you know where to find me.) R.D. Dewberry 2/22/20 Related Videos:

Related Updates:

0 Comments

|

Archives

August 2022

|

RSS Feed

RSS Feed