|

Six Flags announced their Third Quarter 2020 Earnings today, both on paper and on their earnings calls today. A few highlights from the call (shout out to @OnlineHyde for some of this)

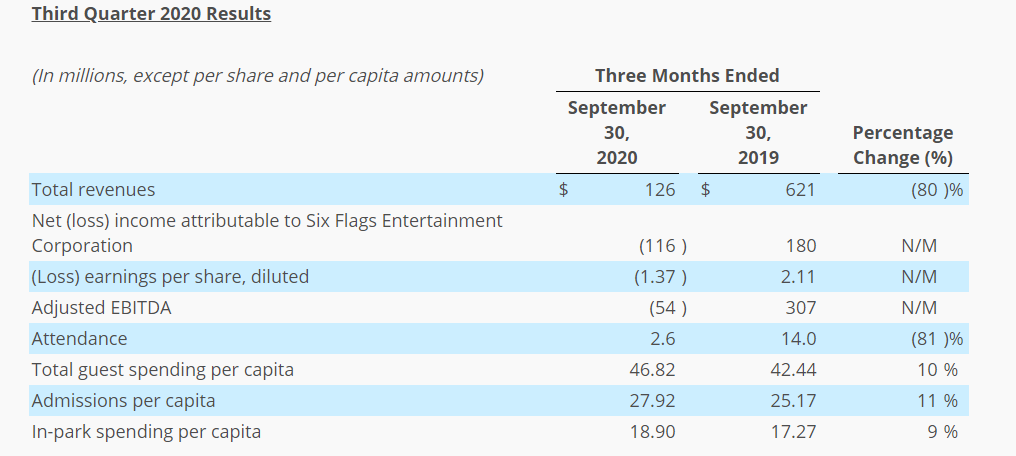

So what does this mean? Some older rides that cost a lot of money to operate are likely to be removed. I'd expect a few fan favorites to be among these, think the reasons why Log Jammer at SFMM was removed (it was the most expensive ride in the park to run). It could also mean some newer rides with low throughput and issues may be removed. Think possibly the Free Spins, Harley Quinn at SFDK and maybe a few others. Would also anticipate some older flat rides being removed at the more popular parks, and being swapped out with newer flats from smaller parks. Think the Round-Up at SFMM or the older top Spin at Great Adventure. I wouldn't expect any Boomerangs or SLC's to be among the rides removed. They are actually reliable, relatively cheap to run and maintain. Also, the elephant in the room here is what parks the chain is looking to ditch. There have been rumors swirling around regarding this for awhile. While not specifically outlined on this call, it's possible rides from some parks on the chopping block will be moved to parks the chain is keeping. The situation is definitely fluid, stay tuned. You can read the entire release below. - Gregg Cash Outflow In-Line with Expectations Transformation Plan Underway ARLINGTON, Texas--(BUSINESS WIRE)-- Six Flags Entertainment Corporation (NYSE: SIX), the world’s largest regional theme park company and the largest operator of waterparks in North America, today reported a decline in revenue and earnings, as anticipated, for the third quarter and first nine months of 2020 as compared to the same periods in 2019. Nine of the company’s 26 parks were closed in the third quarter due to the COVID-19 pandemic, and parks that were open during the period were subject to attendance limitations. The company continues to maintain a cautious and safety-first approach to operating its parks to ensure compliance with social distancing and other safety measures, in accordance with local conditions and government guidelines. While operating conditions continue to be challenging, attendance trends improved from a range of 20% to 25% of prior year levels upon the initial reopening of certain parks in the second quarter to approximately 35% in the third quarter, for the parks that were open.1 The company opened its waterpark in Oaxtepec, Mexico on September 12 and its theme park in Mexico City on October 23, and announced plans to open Six Flags Great America, in Illinois, for a holiday walk-through experience during late November through December. In addition, the company made progress on implementing its transformation plan to improve the guest experience and to reinvigorate long-term profit growth. The company believes this plan will help it to emerge stronger and more profitable once the pandemic subsides. “I would like to thank our team members who have risen to the challenges presented by COVID-19 and improved business performance each month as we safely opened more parks, increased capacity of the parks that were open, and aggressively controlled costs,” said Mike Spanos, President and CEO. “Additionally, I would like to thank our large base of loyal season pass holders and members who stayed with us during this difficult period and continue to come out to our parks in growing numbers.” “The early results of our operational transformation appear extremely promising, and I believe that we will emerge from the pandemic as a stronger and more profitable organization,” continued Spanos. “We made substantial progress towards our goal of modernizing the guest experience as we become a more agile, consumer-centric, productive, and technology-savvy organization. We expect the transformation to enable significant profit growth once our plan is fully executed in a post-pandemic environment.” Third Quarter 2020 Highlights

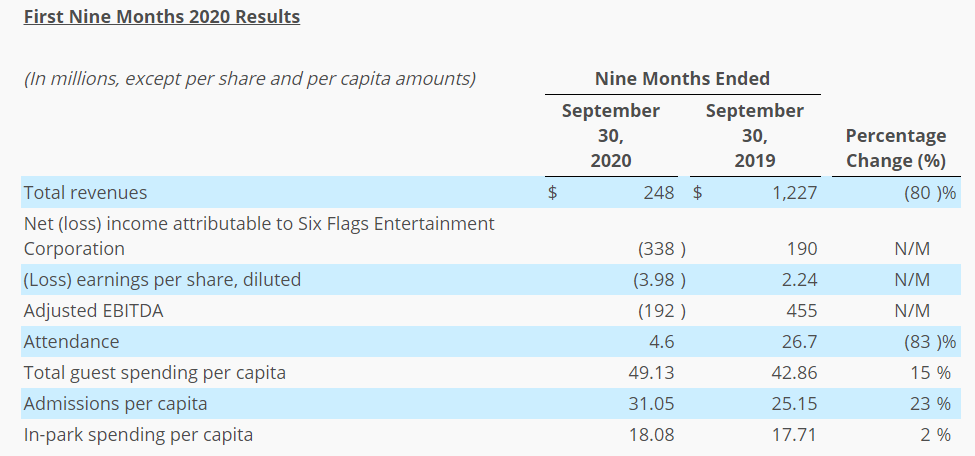

First Nine Months 2020 Highlights

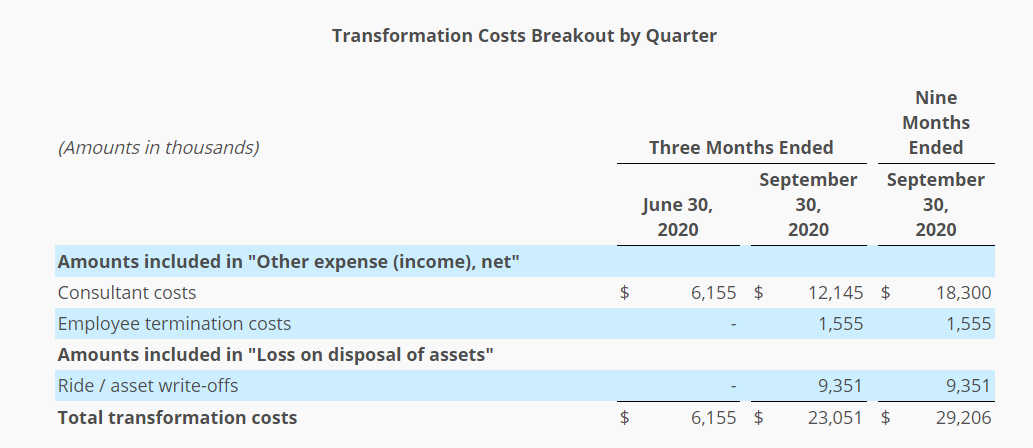

In the third quarter of 2020, the company generated $126 million of revenue with attendance of 2.6 million guests, net loss of $116 million, and an Adjusted EBITDA loss of $54 million. Net loss includes non-recurring charges of $2 million in employee termination costs, $12 million in consulting costs, and a $9 million non-cash write-off of ride assets. These non-recurring charges were all related to the company’s transformation plan. The Adjusted EBITDA calculation reflects an add-back adjustment of approximately $23 million of non-recurring costs related to the transformation plan. The decrease in attendance was due to the temporary pandemic-related suspension of operations at nine of the company’s 26 parks during the quarter and limited attendance at the parks that were open. The decrease in revenue was primarily the result of the decrease in attendance, offset by improved guest spending per capita. The decrease in revenue was also attributable to a $22 million reduction in sponsorship, international agreements, and accommodations revenue primarily related to the previously announced terminations of the company’s contracts in China, which generated revenue in 2019; the suspension of most sponsorship revenue while certain parks were not operating; and the pandemic-related suspension of the majority of the company’s accommodations operations. The company partially offset the decrease in revenue by implementing cost savings measures during the quarter. The improvement in admissions spending per capita for the third quarter of 2020 was primarily due to recurring monthly membership revenue from members who retained their memberships following the initial 12-month commitment period. An increase in the mix of single-day guests also contributed to the improvement. In-park spending per capita in the third quarter of 2020 increased due to a higher mix of single-day guests, who tend to spend more on a per visit basis. In addition, recurring monthly all-season membership product revenue, such as the all season dining pass, from members who retained their memberships on a monthly basis following the initial 12-month commitment period contributed to the increase. For the first nine months of 2020, the company generated revenue of $248 million with attendance of 4.6 million guests, net loss of $338 million, and an Adjusted EBITDA loss of $192 million. Net loss includes non-recurring charges of $2 million in employee termination costs, $18 million in consulting costs, and a $9 million non-cash write-off of ride assets. These non-recurring charges were all related to the company’s transformation plan. The Adjusted EBITDA calculation reflects an add-back adjustment of approximately $29 million of non-recurring costs related to the transformation plan. The decrease in attendance was due to the temporary pandemic-related suspension of park operations beginning on March 13, 2020, and limited attendance at the re-opened parks. The company resumed operations at many of its parks on a staggered basis near the end of the second quarter of 2020 using a cautious and phased approach, which included limiting attendance to encourage social distancing, in accordance with local conditions and government guidelines. The decrease in revenue was primarily the result of the decrease in attendance, offset by improved guest spending per capita. The decrease in revenue was also attributable to a $62 million decrease in sponsorship, international agreements, and accommodations revenue primarily related to the previously announced terminations of the company’s contracts in China and Dubai, which generated revenue in 2019; the suspension of most sponsorship revenue while certain parks were not operating; and the pandemic-related suspension of the majority of the company’s accommodations operations. The improvement in admissions spending per capita for the first nine months of 2020 was primarily due to recurring monthly membership revenue from members who retained their memberships following the initial 12-month commitment period. An increase in the mix of single-day guests also contributed to the improvement. In-park spending per capita in the first nine months of 2020 increased due to recurring monthly all season membership product revenue, such as the all season dining pass, from members who retained their memberships on a monthly basis following the initial 12-month commitment period and the increase in single-day attendance mix. These increases were partially offset by limited catered outing revenue driven by the COVID-19 pandemic and attendance at the company’s drive-through Safari, which offers limited in-park spending opportunities. Active Pass Base The company extended the use privileges for all 2020 season passes through the end of 2021, and offered members the option to pause payments on their current membership through spring 2021. The company is also offering higher-tiered benefits to members that elect to maintain their current payment schedule. As anticipated, the company sold significantly fewer season passes and memberships while many of its parks remained closed, compared to the same period in 2019. As a result, the Active Pass Base, which includes all members and season pass holders, decreased 49% as of the end of the third quarter of 2020 compared to the third quarter of 2019. The Active Pass Base included 1.9 million members, compared to 2.6 million members at the end of 2019 and 2.1 million members at the end of the second quarter of 2020. It also included 1.9 million traditional season pass holders compared to 4.5 million season pass holders at the end of the third quarter of 2019. Deferred revenue was $199 million as of September 30, 2020, an increase of $1 million, or less than 1%, from September 30, 2019. The increase in deferred revenue was primarily due to the deferral of revenue from members and season pass holders whose benefits were extended into 2021, almost entirely offset by lower season pass and membership sales. Balance Sheet and Liquidity As of September 30, 2020, the company had cash on hand of $214 million and $459 million available under its revolving credit facility, net of $22 million of letters of credit, or total liquidity of $673 million. This compares to $756 million of liquidity as of June 30, 2020. The company’s average monthly net cash outflow was approximately $27 million per month, which was within the company’s prior guidance range. Based on the parks that are currently open, the company estimates that its net cash outflow through the end of 2020 will be, on average, $25-$30 million per month.3 The company has no debt maturities until 2024. In the first nine months of 2020, the company invested $90 million in new capital projects, net of property insurance recoveries, paid $22 million in dividends, and prepaid $51 million of its 4.875% notes due 2024. Net debt as of September 30, 2020, calculated as total reported debt of $2,621 million less cash and cash equivalents of $214 million, was $2,407 million. On August 26, 2020, the company further amended its credit facility to, among other benefits, suspend testing of its senior secured leverage ratio financial maintenance covenant through December 31, 2021. The company’s lenders also approved modified testing of its senior secured leverage ratio financial maintenance covenant through December 31, 2022. Through the duration of the amendment period ending December 31, 2022, the company agreed to suspend paying dividends and repurchasing its common stock, and to maintain minimum liquidity of $150 million. In response to curtailed operations, and to preserve the company’s liquidity position, the company continues to take actions to reduce operating expenses and defer or eliminate certain discretionary capital projects planned for 2020 and 2021. The company is able to take additional measures or further modify park operations and park schedules based on changing conditions. At this time, the company believes it has sufficient liquidity to meet its cash obligations through the end of 2021 even if the open parks are forced to close. Transformation Plan The company commenced a major transformation plan in March 2020 to reinvigorate long-term profit growth, including revenue initiatives and productivity initiatives. The organization will focus on modernizing the guest experience through technology, and providing more value for its guests’ time and money. Executing the transformation plan will require one-time charges of approximately $69 million, of which $60 million will be cash and $9 million will be non-cash write-off of ride assets. Approximately $29 million has already been recorded through the end of the third quarter. The company anticipates that it will incur approximately $5 million in charges in the fourth quarter of 2020, with the remaining charges expected to be incurred by the end of 2021. Approximately two-thirds of the investments in 2021 will be on the company’s technology platform to enable the realization of the expected transformation value. The company expects the transformation plan to generate an incremental $80 to $110 million in annual run-rate EBITDA. Relative to the mid-point of the company’s pre-pandemic guidance range of $450 million, this implies a new earnings baseline of $530 to $560 million4 once the plan is fully executed and the company is operating in a normal business environment. The company expects to realize approximately half of the transformation benefits through a reduction in fixed costs that is independent of attendance levels. The company expects to realize the other half of the benefits through incremental revenue opportunities and lower variable costs. Related Videos

Related Updates Comments are closed.

|

Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed